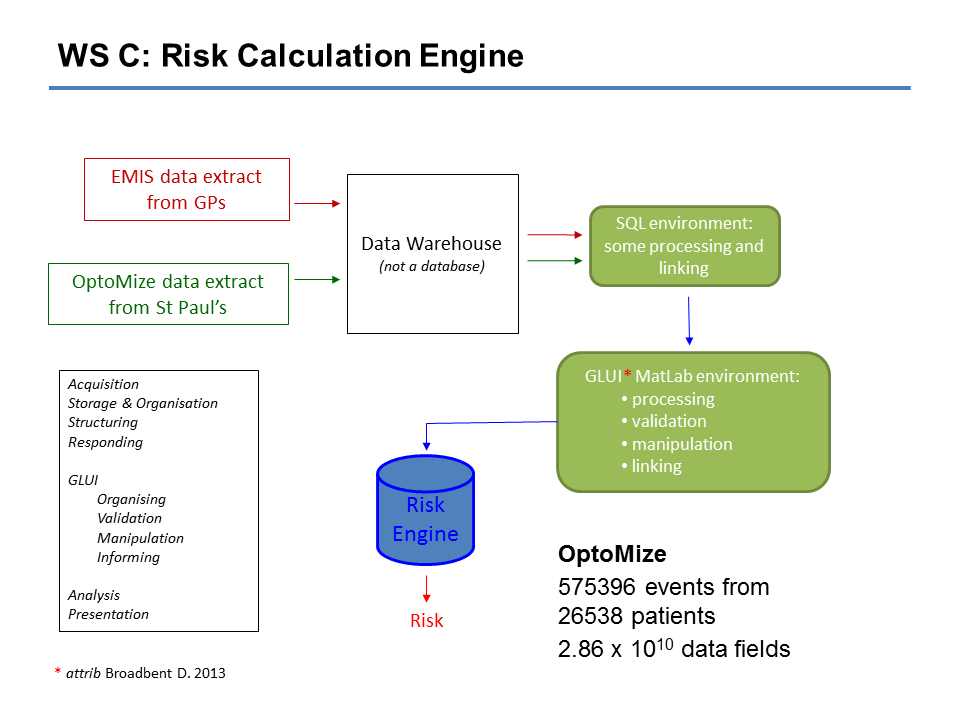

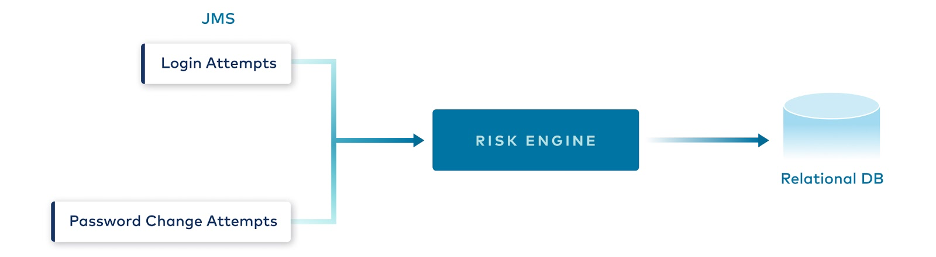

The true power of the Voltz Protocol is unlocked when an actor trades or deposits with leverage: the ratio of their notional supplied to initial margin deposited, as controlled by the protocol. An excellent overview of all these actors, and more besides, can be found in the Voltz Protocol General Concepts guide.įigure 1 (above): Overview of the Voltz protocol. The money market is generated using concentrated liquidity pools, where Liquidity Providers (LPs) deposit funds and collect fees. This lets more sophisticated traders increase potential profit capture on the rates of individual assets. Whilst we describe the other side as Variable Takers (VTs), where you swap a fixed rate and end up with a variable rate of return. This provides traders with the ability to de-risk their portfolio by ‘locking in’ a fixed interest rate. In an IRS, we describe one side as Fixed Takers (FTs), where you swap a variable rate and end up with a fixed rate of return. On the protocol, you can exchange ‘variable rates for fixed rates’ or ‘fixed rates for variable rates’ in an interest rate swap (IRS). Voltz Protocol1 is a noncustodial Automated Market Maker (AMM) for Interest Rate Swaps, unlocking the power to trade interest rates, with substantial leverage. In specific market scenarios, LPs can safely take leverage >1000x and traders >500x.Combining the above, we demonstrate that actors taking >100x leverage with Voltz are safe against liquidations and insolvencies.New liquidation and insolvency risk measures have been developed: LVaR and IVaR.The Risk Engine simulates a variety of Voltz IRS pools, covering different APY volatilities, fixed-rate markets, actor leverages, and liquidity pool concentrations.We use state-of-the-art financial engineering to bring you the Voltz Risk Engine.

0 kommentar(er)

0 kommentar(er)